Introspective Market Research Forecasts Global Insomnia Treatment Market to Reach $5.76 Billion by 2032.

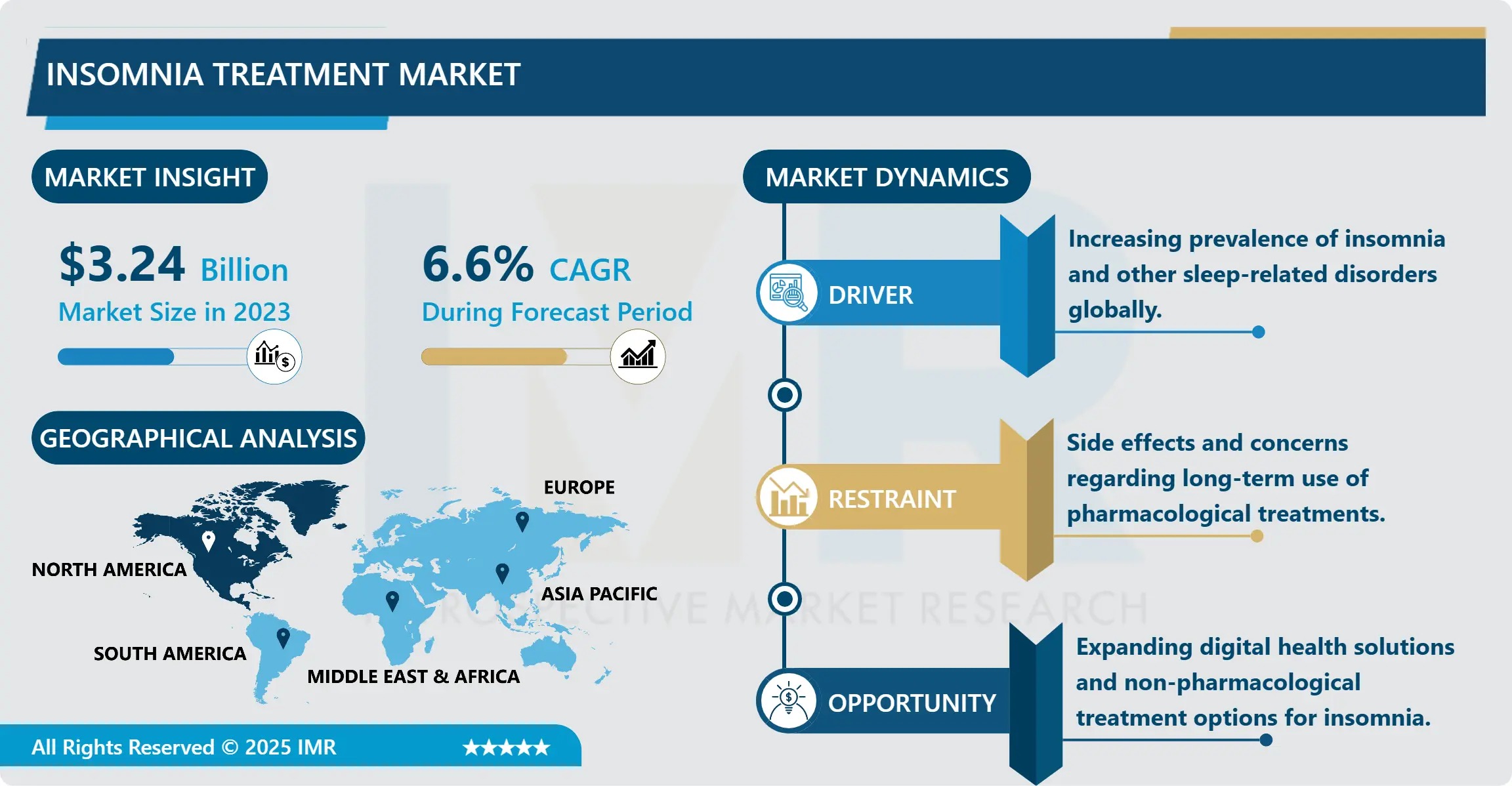

The Global Insomnia Treatment Market, valued at USD 3.24 billion in 2023, is projected to reach USD 5.76 billion by 2032, growing at a robust CAGR of 6.60% from 2024 to 2032, according to a new comprehensive analysis by Introspective Market Research.

This expansion is being driven by a confluence of macro-level forces: rising global prevalence of chronic sleep disorders (affecting up to 30% of adults), intensifying awareness of sleep’s role in metabolic and cognitive health, and the accelerating integration of digital therapeutics (DTx), telemedicine, and wearables into mainstream care pathways. As insomnia shifts from a “lifestyle nuisance” to a recognized comorbidity of depression, anxiety, cardiovascular disease, and neurodegenerative disorders, treatment paradigms are undergoing a profound evolution-from short-term pharmacotherapy to personalized, multimodal solutions anchored in behavioral science and data-driven monitoring.

- 2023 Market Size: USD 3.24 Billion

- 2032 Projected Value: USD 5.76 Billion

- CAGR (2024–2032): 6.60%

- Dominant Treatment Segment: Prescription Medications (still largest revenue generator, but CBT-I and DTx growing fastest)

- Leading Drug Class: Benzodiazepines (largest share in 2023), though Non-Benzodiazepine Hypnotics and Melatonin Agonists show strongest growth

- Fastest-Growing Modality: Digital Therapeutics & CBT-I Apps (CAGR >14% projected through 2032)

- Top Regional Market: North America (41.3% share in 2023; driven by US adoption of integrated sleep clinics and payer coverage for DTx)

- Key Industry Players: Pfizer Inc., Johnson & Johnson, GSK plc, Eli Lilly and Company, Merck & Co., Takeda, Vanda Pharmaceuticals, Akeso Inc., Kyorin Pharmaceutical, Lupin Pharmaceuticals

- Emerging Disruption: FDA-cleared prescription DTx platforms (e.g., Sleepio, Somryst) now reimbursed by major US insurers-including Cigna, Aetna, and UnitedHealthcare

Why Is Insomnia Treatment Shifting from Pills to Platforms—and What Does That Mean for Pharma, Providers, and Payers?

The answer lies in three converging realities:

✅ Pharmacotherapy fatigue: Growing concern over dependency, cognitive side effects, and rebound insomnia with long-term benzodiazepine use.

✅ Evidence superiority: CBT-I demonstrates >70% response rates in chronic insomnia—with effects sustained 6–12 months post-treatment, outperforming drugs in durability.

✅ Tech-enabled access: Smartphone penetration (85%+ in high-income nations) and wearable adoption (1 in 3 US adults) have turned sleep into a measurable, modifiable biomarker.

As a result, integrated treatment models are gaining traction:

🔹 Step therapy protocols now recommend CBT-I before hypnotics for chronic cases (per AASM 2024 guidelines).

🔹 Hybrid care-combining app-based CBT-I with brief clinician oversight—is reducing treatment costs by 40% in employer wellness programs.

🔹 AI-powered sleep coaches (e.g., ResMed’s SleepHQ integration, Philips’ SmartSleep) are enabling real-time adaptive interventions.

“We’re witnessing the ‘digital first’ inflection point in sleep medicine,” says Dr. Anjali Kapoor, Principal Consultant, Neurology & Behavioral Health Practice at Introspective Market Research.

“Prescription drugs still anchor acute care, but the value is migrating upstream—to prevention, personalization, and persistence. The winners aren’t just drug developers anymore—they’re the platforms that embed behavioral change into daily routines. Think of insomnia treatment not as a pill, but as a service layer atop hardware (wearables), software (apps), and human expertise (coaches, therapists). That’s where reimbursement innovation—and investor interest—are accelerating fastest.”

North America (41.3% Market Share)

The U.S. dominates due to:

- High insurance coverage for insomnia-related visits (85% of commercial plans now include CBT-I)

- FDA’s Digital Health Center of Excellence fast-tracking DTx approvals (8 insomnia DTx cleared since 2022)

- Employer-driven demand: 68% of Fortune 500 companies now offer digital sleep benefits (e.g., Calm for Business, Sleepio Enterprise)

- Integration into primary care via EHR-embedded screening tools (e.g., STOP-BANG, Insomnia Severity Index)

Canada is advancing rapidly via publicly funded digital mental health hubs (e.g., AbilitiCBT in Ontario), while Mexico sees rising OTC melatonin and herbal remedy use-driven by limited access to specialists.

Europe (29.5% Share)

Western Europe (Germany, UK, France) leads in CBT-I delivery through national health systems-NHS England’s Improving Access to Psychological Therapies (IAPT) program now includes insomnia as a core pathway.

Eastern Europe shows high unmet need: stigma, low diagnosis rates, and fragmented care keep pharmacotherapy dominant-but telemedicine startups (e.g., Moodpath in Germany, Sanvello partnerships in Poland) are bridging gaps.

Asia Pacific (22.4% Share — Fastest-Growing Segment)

Urbanization, high-stress work cultures, and aging populations are driving double-digit growth in:

- Japan & South Korea: Rising geriatric insomnia (≥65 y/o prevalence >45%), fueling demand for low-sedation melatonin agonists (e.g., ramelteon).

- India & China: Explosive OTC melatonin and herbal supplement markets-valerian, ashwagandha, jujube—supported by e-pharmacy growth (120M+ sleep-related searches on PharmEasy/1mg in 2024).

- Australia: First-mover in DTx reimbursement-Medicare now covers Sleepio via GP referral (MBS Item 92432).

By Treatment Type (2023 Share & Growth Outlook)

Segment | 2023 Share | Key Growth Catalyst |

|---|---|---|

Prescription Medications | ~38% | Legacy dominance; new formulations (e.g., controlled-release zolpidem) improving safety |

CBT-I & Behavioral Therapy | ~22% | Gold standard for chronic insomnia; insurance coverage expansion |

Digital Therapeutics (DTx) | ~12% (but 14.1% CAGR) | FDA-cleared, scalable, cost-effective; ideal for employer/managed care adoption |

OTC Medications | ~15% | Melatonin sales up 200% since 2020 (U.S. alone: USD 900M+ in 2024) |

Sleep Monitoring Devices & Wearables | ~8% | Integration with DTx; Apple Watch, Fitbit, Oura Ring driving consumer self-diagnosis |

Herbal & Alternative Therapies | ~5% | Strong in APAC/LATAM; regulatory gray zone but high consumer trust |

By Drug Type

- Benzodiazepines (e.g., lorazepam, diazepam): Largest share, but declining CAGR (2.1%) due to safety concerns.

- Non-Benzodiazepine Hypnotics (e.g., zolpidem, eszopiclone): 28.7% share-balance of efficacy and tolerability; generics driving volume.

- Melatonin Agonists (e.g., ramelteon, tasimelteon): Fastest-growing drug class (9.8% CAGR); preferred for elderly and circadian rhythm disorders.

- Antidepressants (e.g., trazodone, mirtazapine): Widely used off-label-especially in comorbid anxiety/depression.

- Emerging: Orexin antagonists (e.g., suvorexant, lemborexant)-targeted mechanism, lower abuse potential.

- Innovation Spotlight: Who’s Reshaping the Sleep Care Continuum?

Pfizer Inc. (USA) – Launched Zolpimist® XR (extended-release zolpidem oral spray) in Q3 2025—faster onset, reduced next-day impairment. Now in Phase IV real-world adherence studies.

Vanda Pharmaceuticals (USA) – Secured CMS coverage for Hetlioz® (tasimelteon) in Non-24-Hour Sleep-Wake Disorder and shift-work insomnia-first circadian regulator with Medicare Part D inclusion.

Akeso Inc. (USA) – Received FDA Breakthrough Device designation for NeuroSleep™, an AI-guided CBT-I platform that adapts modules using wearable (Oura/Whoop) biometric feedback.

Takeda (Japan) – Partnered with SleepScore Labs to validate Dayvigo® (lemborexant) efficacy in real-world sleep architecture via contactless bedside sensors-data used for EU label expansion.

Lupin Pharmaceuticals (India) – Launched Melatonex™, a plant-extracted, chronobiotic-grade melatonin (5mg SR) with GRAS certification-capturing premium OTC segment in APAC.

- Cost-Pressure Mitigation & Efficiency Strategies

- Hybrid DTx Models: Combining app-based CBT-I with <4 live therapist sessions cuts cost per responder from USD 1,200 (in-person) to USD 350.

- Payer Risk-Sharing: Outcomes-based contracts (e.g., “pay-per-night-gained”) for DTx—piloted by Oscar Health and Sleepio.

- Pharmacy Integration: Walgreens & CVS embedding sleep screenings in MinuteClinics, triggering OTC + digital bundle referrals.

- Generics & 505(b)(2) Pathways: Accelerated approvals for reformulated hypnotics (e.g., sublingual melatonin, low-dose doxepin) reducing price pressure on innovators.

- Tangible Benefits Across Stakeholders

Stakeholder | Key Benefit |

|---|---|

Patients | Fewer side effects, sustained improvement, 24/7 access, stigma reduction via app-based care |

Providers | Enhanced workflow integration (EHR alerts, automated ISI scoring), expanded capacity via digital triage |

Payers | 22% lower total cost of care for insomnia + comorbid depression when DTx used early (per JAMA Intern Med 2025 meta-analysis) |

Employers | ROI of 3.2x via reduced absenteeism, presenteeism, and healthcare utilization (per Willis Towers Watson study) |

Pharma | Lifecycle extension via digital combo products (e.g., drug + app), new revenue via subscription models |

Access the Full Strategic Intelligence Report

The Insomnia Treatment Market Report (2024–2032) by Introspective Market Research delivers 230+ pages of actionable insights:

- Treatment pathway mapping across 12 countries (from diagnosis to maintenance)

- DTx reimbursement landscape: FDA, CE, NICE, PMDA, CDSCO coverage status

- Competitive benchmarking: 18 company profiles with pipeline, partnerships, pricing (USD/pill, USD/user/month)

- Patient segmentation: acute vs. chronic, age-stratified, comorbidity-based (anxiety, pain, menopause)

- Forecast models by modality, region, and delivery channel (clinic, telehealth, app store, pharmacy)

Download a Free Sample Report:

https://introspectivemarketresearch.com/request/20198

About Introspective Market Research

Introspective Market Research(IMR) is a globally recognized leader in strategic intelligence for neuroscience, mental health, and digital therapeutics. Our team combines clinical expertise with commercial acumen-conducting primary interviews with 350+ sleep specialists, payers, DTx developers, and employers-to deliver foresight that informs R&D prioritization, market access, and partnership strategy.

We don’t just report on the sleep economy-we help build resilient, patient-centered care models.

Media Contact

Dr. Neha Sharma

Senior Director, Neuroscience Communications

Introspective Market Research.

Call:- +91 91753-37569.

Email:- info@introspectivemarketresearch.com